Bank reconciliation refers to the process of matching a business’ financial records with the bank statements.

Accountants and other financial experts depend on this process to put the books of a business in order. Without bank reconciliation, it could be nearly impossible to catch fraud and financial discrepancies.

If you want to learn how to streamline your business’ bank reconciliation, this article is for you. Read on to get started.

Your Internal Records Should Be Up to Date

For many business owners, it might be quite difficult to find the time to put all of their financial documents in order. Before getting into the bank reconciliation process, making sure all of the accounting records are accurate is a must.

All of the outgoing checks should match all of the bills you recently paid.

Obtain Bank and Credit Card Statements

To make bank reconciliation a breeze, start by obtaining a list of all of your transactions from the bank and credit card companies. Some business owners use data software that sends all of their bank information straight into their accounting software.

Track Your Business Records

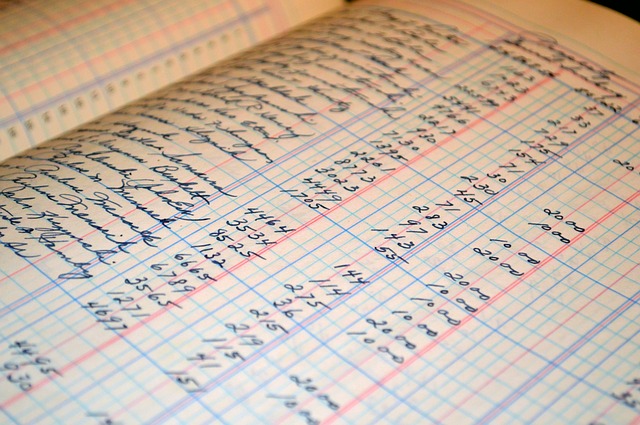

When you’re in the process of reconciling, you also need to obtain a copy of all of your business records. Some small businesses like to keep a spreadsheet or logbook of all of their income and outgoings.

Find a Good Starting Point

To get ready to reconcile, find when your business books matched your bank account statements. Once you find it, make this a starting point to begin reconciling.

Make it a Monthly Reconciliations

If you want to make your bank reconciliation run a lot smoother, you need to do them monthly.

When you get your monthly bank statements either by mail or electronically, set aside some time to review them. Keeping up with the monthly statements makes it a lot easier to prevent mistakes in the long run.

Reconcile in Detail

To begin reconciling, you need to go through all of your items such as deposits, income, withdrawals, expenses, and end balances.

Start by going through all of your deposits and ensure every single transaction appears in your account. After you account for all of the deposits, categorize it between sales, interest, refund, and other. Once you have a good record of all of the deposits, you need to match them with your bank statements.

The next step is to go through all of the bank withdrawal transactions and account for all of them. Expenses also need to match your records and bank statements. If there are any discrepancies with the expenses, you need to get to the bottom of it.

Finally, you need to make sure the end balance matches the deposits and withdrawals.

Bank Reconciliation: The Bottom Line

Now that you know how bank reconciliation works, it’s time you make it work for your business. Remember to update your internal records, obtain credit card statements, and reconcile in detail

Do you need help with bookkeeping and accounting? We’re here to help. Contact us to learn more.