There’s never been a more exciting time to be in business. It’s never been easier to start a business, for one. Many small- and medium-sized independent business owners have access to tools so powerful that would have been a dream even for a Fortune 500 CEO 20 years ago. That’s one reason that over 627,000 new businesses are started each year.

These opportunities come with their own challenges as well, however. Many people starting businesses for the first time don’t have the training or background in business to understand all the ins and outs of running a company. We can’t all be MFAs.

Bookkeeping is one of those skills that’s essential for running a business effectively. Despite its power, you don’t always hear about it. If you’ve been wondering “What is bookkeeping?” here are some answers to help illuminate you.

What Is Bookkeeping?

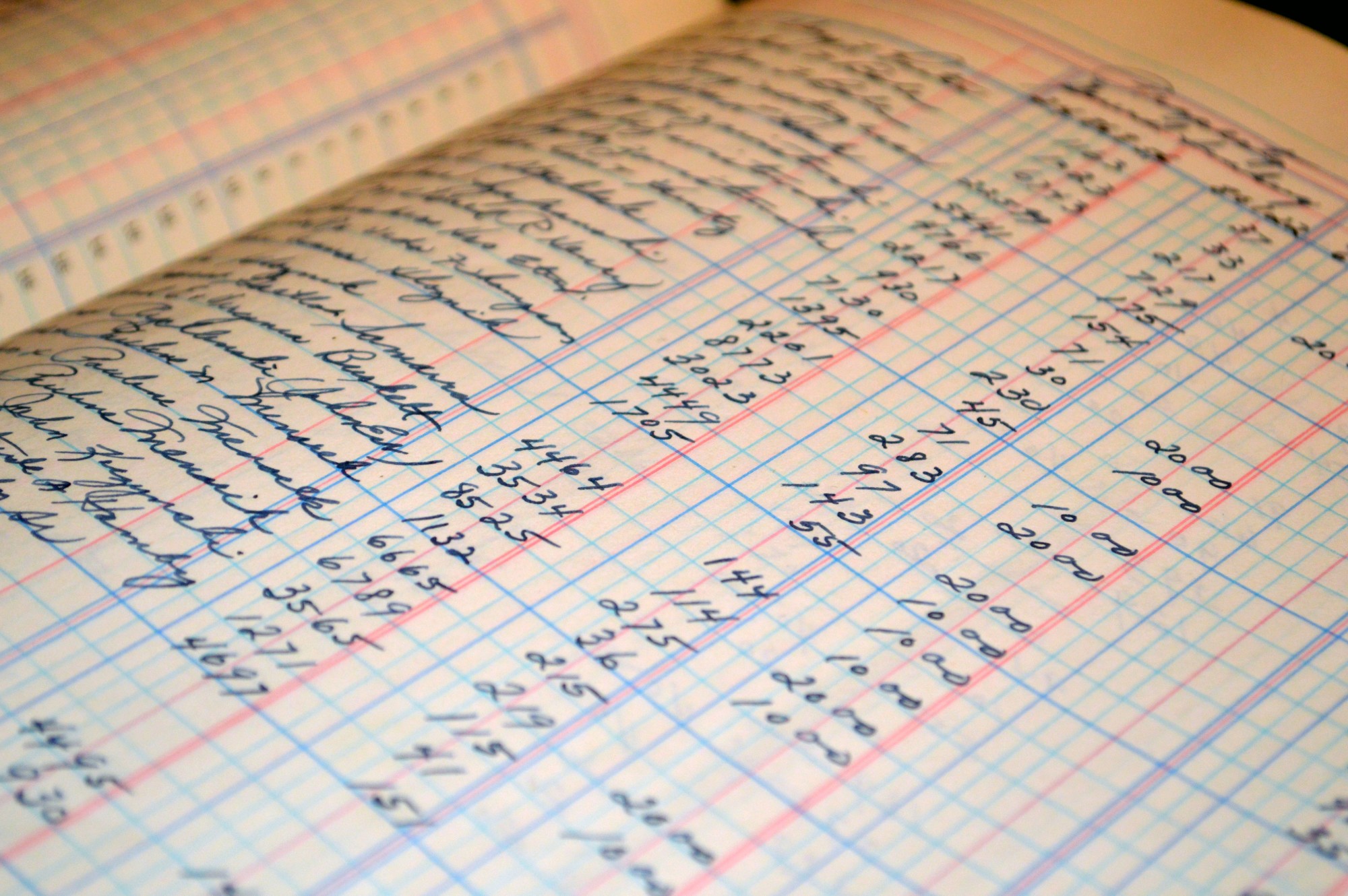

The answer to the question “What is bookkeeping?” is both more simpler and more complex than it might seem. Have you ever seen a spreadsheet with columns of numbers? That’s one example of bookkeeping.

It’s beyond important that you keep tabs on your business’ financial standing. 82% of businesses fail due to problems with cash flow. If you’re not keeping an eye on your accounts receivable you could end up coming up short by the time bills are due.

The term ‘bookkeeping’ is simply a fancy way of saying accounting. The official textbook definition of bookkeeping is the systematic recording and classifying of financial data.

Bookkeeping would be pretty simple if we only ever dealt in cash and hard currency. Unfortunately, that’s not the case. Almost every business has some form of accounts receivable coming in at different times. There are always accounts payable going out at different times, as well.

Things can get complex pretty fast, even with small businesses. It gets even more complex when you consider having to paying tax on all of your earned income.

It’s important to have a bookkeeping system in place before that happens.

Bookkeeping most commonly follows the double-entry system. A double-entry system tracks both physical assets as well as money owed.

Say, for instance, that you take a loan out from the bank. You would enter a credit into your assets entry, as you’d have more cash on hand. You would enter a debit into your accounts payable at the same time, however.

Accounting and bookkeeping are relatively simple once you get the hang of them. There are a ton of tricks and specialized information that go into it, as well, however. That’s where having a well-trained bookkeeping professional comes into play. Having an accountant on-hand means you never have to worry about things slipping between the cracks.

You’ll always know exactly where your money’s at and where it needs to go.

Looking For Bookkeeping Services?

Whether you’re new to the business world and answering “What is bookkeeping?” for the first time or a well-established corporation that is looking to upgrade your bookkeeping service, we can help you! Contact us today with any questions!